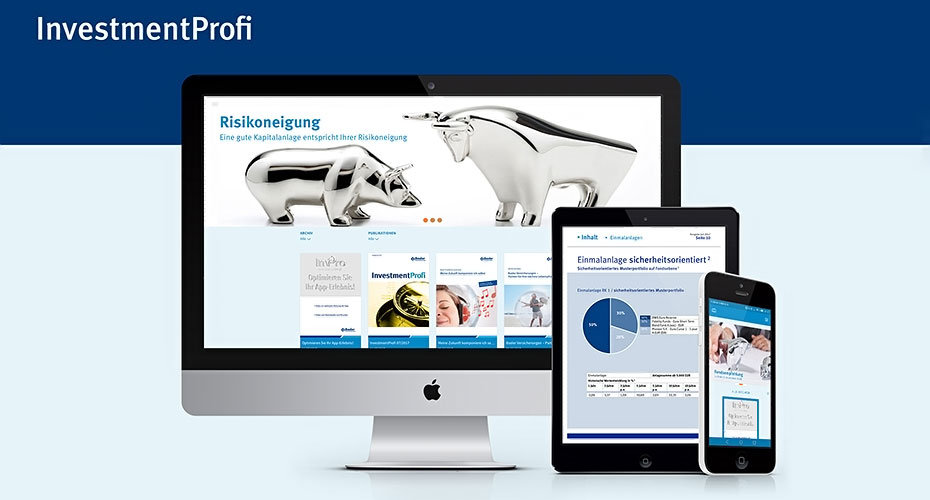

Digital solutions for business documents and customer magazines have become the standard in customer service. We spoke with Ralph Castiglioni, a managing director at Basler Financial Service GmbH, about what moved the company to create a digital version of their investment magazine InvestmentProfi, and the challenges they faced. The end result is an efficient, cost-saving sales and customer app that features clever navigation and an easy-to-understand, new approach to structuring information.

PressMatrix (PMX): Security is one of the brand messages of Basler insurance products. How do you provide customers with security these days?

RC: The word security, i.e., the state of being safe or sure, is at the heart of the word insurance. We at Basler Versicherung are there for our customers. That’s our promise and we stick to it. We give our customers security by advising them thoroughly and we go to the bat for our customers and their interests. Just as important are our other two brand values, simplicity and cooperation. They both describe our vision of how we want to engage with our customers and our business partners – with uncomplicated products, simple processes, and clear communication, and in trusting relationships characterized by respect and value creation.

PMX: Basler Versicherungen has offered investment consulting services since the 1970s. To provide the best possible investment advice to your customers, you publish InvestmentProfi magazine. What prompted you to create a magazine dedicated to this topic?

RC: The magazine is not a magazine in the conventional sense of the word. We believe that well-informed customers are better customers. So, our magazine is more of a how-to guide with sample portfolios that show investors the best way to put a custom portfolio together with a consultant. It helps investors create diversified portfolios and, as a result, reduce risk. Basically, it builds on the information in our product literature and takes it a bit further.

PMX: As of July 2017, the magazine is also available in the form of an app. What were the motivations and drivers behind the decision for a mobile solution?

RC: The digital expectations of our customers are growing steadily. If you’re on a big-city metro these days and look around, you don’t see anyone reading books or magazines anymore – everybody’s using their smartphone. Taking paper documents with you is just too inconvenient. It’s much easier to get that information on your smartphone or tablet – it just takes a few clicks. We want to offer our customers and consultants that same ease of use. And by publishing the content on our app, we also save costs – for example, on the shipping of individual magazine issues. In the future, we’d rather invest that money in the actual content of the magazine and in additional services.

PMX: To give your customers a better understanding of the app, you’ve created a video with an explanation of the app’s navigation and features. In our opinion, that’s a great solution. Is what we’re seeing here evidence of your second brand value, simplicity?

RC: I’m glad that you like our solution! I believe the financial industry needs to put greater focus on sustainable and understandable consulting. Nobody can afford to spend a lot of time figuring these things out, which is why user-friendliness – and ultimately simplicity – is such a priority for us. We want everybody to be able to use our products.

Our how-to videos explain complex issues simply and understandably, and they don’t take long to do it. The videos are also helpful as a way for customers to prepare for a consultation with one of our representatives.

PMX: InvestmentProfi is quite heavy on numbers – the print issues, in particular, contain impressive tables that span multiple pages. How did you solve that problem in the app? Are there any further challenges to master as you implement these features?

RC: Historical data and ROI estimates are the foundation for anyone entering the investment business. To help users gain a broader understanding of the system, the app provides hyperlinks to additional information about the numbers. What’s also helpful is that the digital publication – unlike the print version – can be made longer if necessary, i.e., we can add pages. And we’ve made good use of that option. Instead of the 24 pages that the print version has, we have over 100 pages in the app. Thanks to the additional space, we can structure information better and present it much more clearly. To offer the users of our app an intuitive interface even on small screens, we have been working with color codes that identify different risk classes.

Because InvestmentProfi is seldom used in a linear fashion (especially in consulting situations), navigation was a particular challenge. It was important that regardless of where the user was in the app, they should always be able to easily access certain types of data. It wasn’t easy to create a navigation system that was easy to understand and that didn’t steer the user to a “dead end,” even in dynamic situations. The feedback we’re getting from users, though, assures us that we’ve mastered the challenge.

PMX: When you decided to go digital, what prompted you to choose PressMatrix?

RC: It was important for us to provide our customers and consultants with digital access in addition to conventional print documents. Using the app from PressMatrix is easy and efficient, both for us and for our customers. And any changes that we want to make can be integrated easily. That saves time and is climate-neutral. Essentially, we’ve got a magazine that is up-to-date and relevant 365 days a year. PressMatrix has proved to be an experienced and innovative partner.

We believe that well-informed customers are better customers.”

PMX: What has your experience been with the app so far? What do your customers say?

RC: Our experience has been positive across the board. And our customers find the app very handy and useful, too. Here’s a quote from one of our app store reviews: “Very good app, easy to use!” Naturally, we’re continuing to optimize the app and communicate with our customers.

PMX: In addition to InvestmentProfi, you’re also publishing your customer magazine NummerSicher, offering how-to videos on various topics, and regularly posting tips and advice on your Basler blog and on Facebook. Are you making a change in your approach to customer service – from representative to app?

RC: The growth in ROPO customers (research online, purchase offline) is a significant trend in many industries, including ours. Customers want to get information on the Web before they take any other steps. As far as we’re concerned, personal consultation will never be discontinued in favor of an entirely automatic process. We want to be part of the digital movement and offer our customers and consultants the best possible processes and solutions, so it’s even easier for them.

What’s more, new technologies are an excellent fit for sales and marketing processes. They also provide support during the consultation phase, and help to close the contract. We recently launched our robo-advisor, www.monviso.de, a digital investment consultant. Customers are taken through a smooth and simple consultation process and, without leaving the comfort of home, can sign up for professional asset management for investments of just 400 or even 50 euros per month. This complements more classic consulting arrangements and allows us and our customers to take advantage of new digital opportunities. And of course, in the future, we will make this technology available to our “human” consultants, too. After all, they still have a much closer relationship with the customers.

RC: To begin with, we’re focusing on the formats our customers already use. The market is still too small for financial services. Various analyses have confirmed that audio content is not relevant for us yet. We’re keeping our eye on the situation, though, and will make changes as necessary.

PMX: Before we finish, can you give us a personal recommendation for a fund that’s performing well?

RC: It’s not possible to make a recommendation across the board. Just as our customers are all different, the same is true of the recommendations we make. We offer our customers unique investment solutions. Based on their personal preferences and knowledge, we put together an investment portfolio that is tailored specifically for them, either together with a consultant or from the comfort of their home, using our digital approach. So, to answer your question, my recommendation is to meet up with a consultant and use digital media to educate yourself.

Ralph Castiglioni has been a managing director at Basler Financial Service GmbH since 2014. He heads the sales and marketing division. Basler Financial Service GmbH has been owned 100% by Basler Versicherungen since 1970, and informs and advises investors about investment funds.